Debt Ceiling Scenarios

With so much emotionally extreme language currently being used by the media regarding the government's budget problems, this piece provides historical perspective and a few plausible outcomes. The U.S. Debt Ceiling Debate investment brief from the Lord Abbett investment firm attempts to address these 3 main questions:

1. Will the debt ceiling be raised before the government runs out of money?

2. What can the government do to prevent a U.S. default if the issue is not resolved in time?

3. If no agreement is reached, what are the potential ramifications for investors?

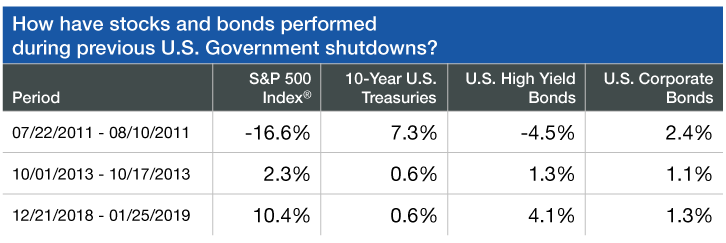

It’s important to remember that we have been in this situation quite a few times in recent history. We survived the three prior episodes in which talks extended past the X date without incurring a total catastrophe. These resulted in partial government shutdowns (2011 - first Obama Administration, 2013 - Obama second term, and late 2018-early 2019 - Trump Administration). This could actually have negative implications if it gives politicians confidence that the deadline can be ignored. But it also provides perspective on what might be a likely outcome over the next few weeks.

The biggest risk is if the government were to actually default on debt payments. The unlikelihood of a “true” default is explained well in the article. It’s also noted that, “furloughing nearly one million government employees, while shutting down many services, could have a chilling effect on U.S. economic growth, at a time when many investors are already worried about the implications of tightening lending standards from regional banks. However, any impact would likely be short-lived, as we witnessed with prior shutdowns.” The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Every potential crisis we face economically feels "different" and often times worse than similar episodes in the past. Hopefully the Lord Abbett folks have a correct view and the representatives in Washington will somehow figure out how to move things along without causing too much damage! We've recently taken a bit more risk off the table in our portfolios for various reasons, but a long term view to investing is still the most successful path for almost all situations.