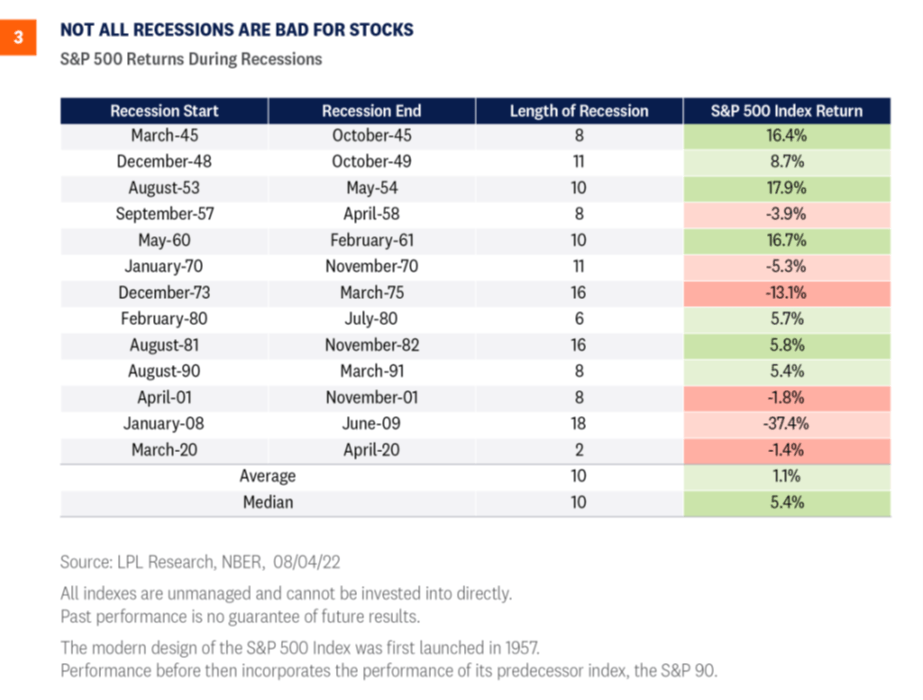

I’ve been fielding many questions about economic recessions, mainly in the realm of how to achieve positive returns if we are in or headed for a slowdown. The graph below provides an historical picture of what markets have done during recessions.

As you look at the numbers you may wonder how it is possible for share price growth during a recession. The main explanation is that the stock market is a “leading indicator”, meaning its movements often precede what will likely occur in the future. If this holds true for our current situation, the approximate -24% decline we had from highs in January to the June 16 low, may have marked a coming recession. These pullbacks usually come before they are expected and often switch direction before the actual economic effects of a slowdown have fully kicked in. This means that there have been many times in the past when profits and earnings recede, unemployment increases, and the stock market climbs . . . preceding the next cycle of growth. Will it happen this way in our current situation? Of course, no one really knows. This is one of the reasons it’s important for long-term success to stay invested. The recent bounce of nearly 13% earlier this month also supports this strategy.

Hope you are doing well and able to enjoy late summer weather and activities!